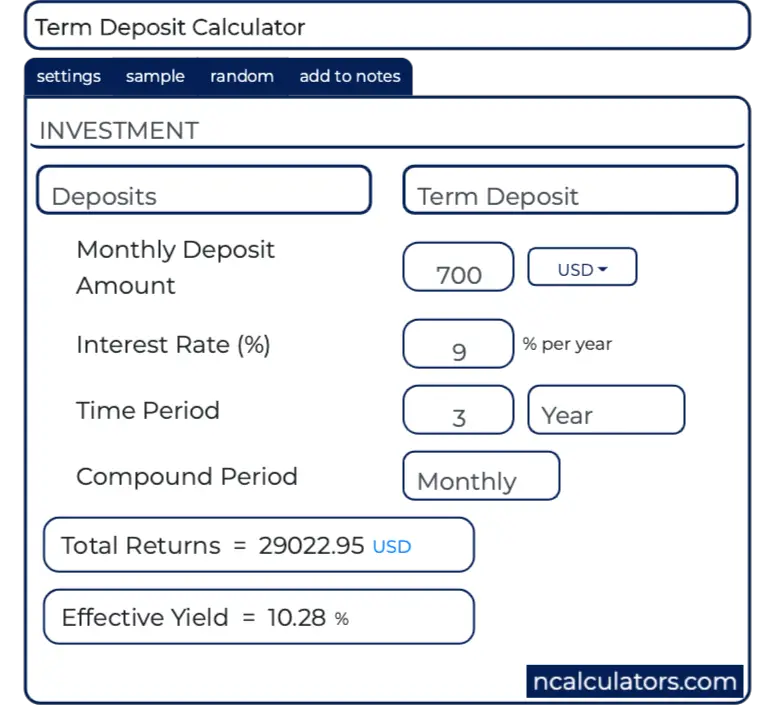

Term deposit compound interest calculator

R is the annual interest rate. How do you calculate interest on a term deposit.

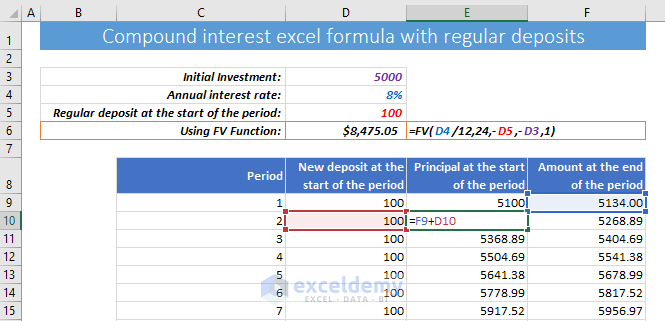

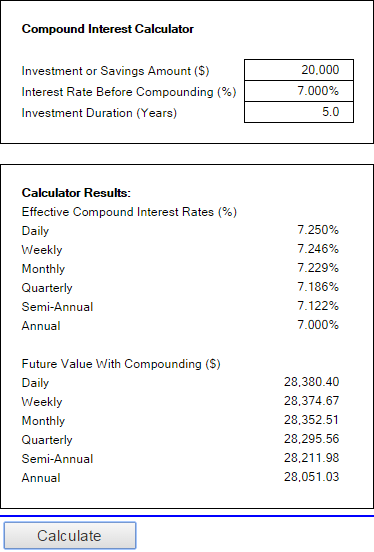

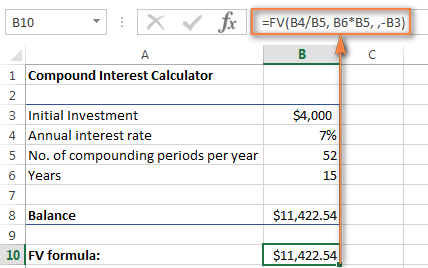

Compound Interest Formula And Calculator For Excel

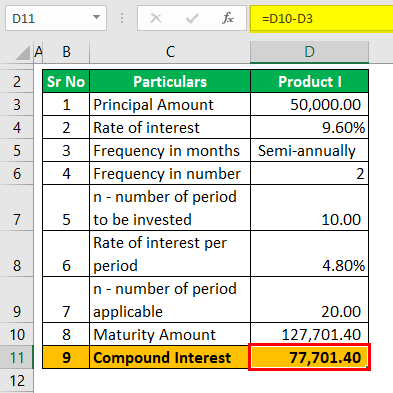

Tables are based on an investment of 50000 in a personal term deposit with interest paid as specified.

. Enter the deposit period in months. For example if a sum of Rs 10000 is invested for 3 years at 10 compound interest rate quarterly compounding then at the time of maturity A. In line with Kailuas request above I am seeking an excel formula for compounding interest with a STARTING monthly deposit of 100 invested at 7 per year compounded annually and increasing the monthly deposit by 3 per year ie.

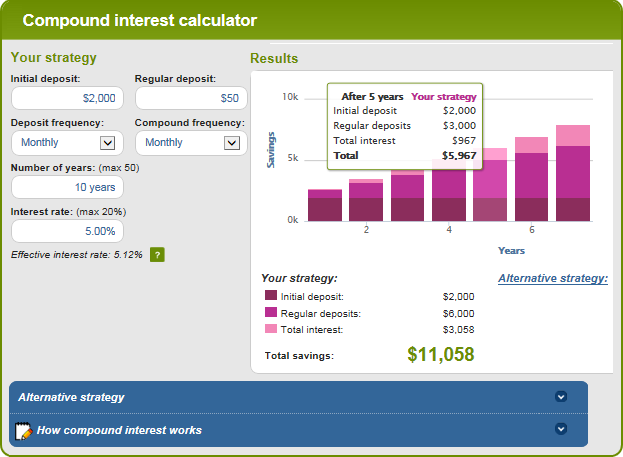

After a year youve earned 100 in interest bringing your balance up to 2100. For example lets say you deposit 2000 into your savings account and your bank gives you 5 percent interest annually. Which can be certificates of deposit bonds savings accounts and many others.

Include additions contributions to the initial deposit or investment for a more detailed calculation. Enter the initial deposit amount. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance.

However banks generally offer a lower rate of interest on term deposits that pay. Benefits of using a Post Office Recurring Deposit Calculator. A certificate of deposit is an agreement to deposit money for a fixed period that will pay interest.

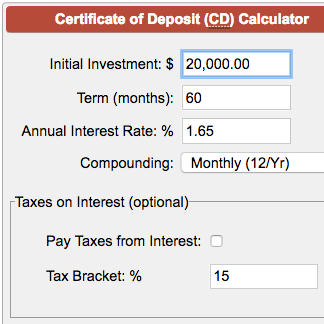

A compound interest calculator is a powerful tool for anyone who wants to save money and calculate compound interest. CI 13449 10000 Rs. Advanced certificate of deposit calculator with contributions eg.

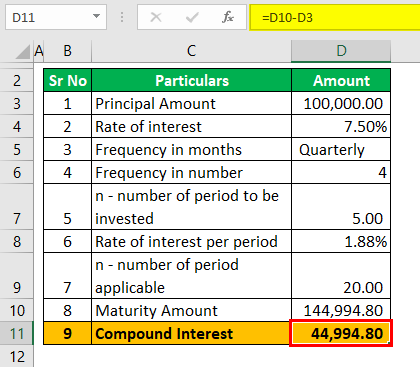

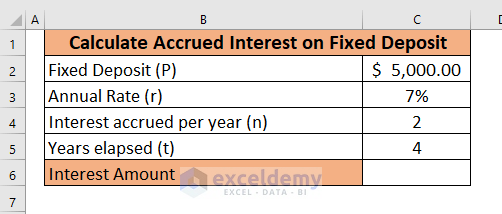

Compound Interest CI Earned over 3 years Maturity Amount Principal Amount. Enter the bank interest rate in percentage. Especially for long-term investments like retirement accounts.

This solver can calculate monthly or yearly fixed payments you will receive over a period of time for a deposited amount present value of annuity and problems in which you deposit money into an account in order to withdraw the money in the future future value of annuityThe calculator can solve annuity problems for any unknown variable interest rate time initial deposit or. Here are the top term deposit rates on Canstars database at the time of writing based on six-month 12-month 24-month and five-year terms. M P P x r x t100.

Monthly deposits inflation adjustment and tax on interest. For example your bank may offer higher interest rates if you deposit an amount greater than 25000 as opposed to if you park a smaller sum of maybe 5000 in a term deposit. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

Products are sorted by highest advertised rate then alphabetically by provider name. See how much you can save in 5 10 15 25 etc. Year 4 would see.

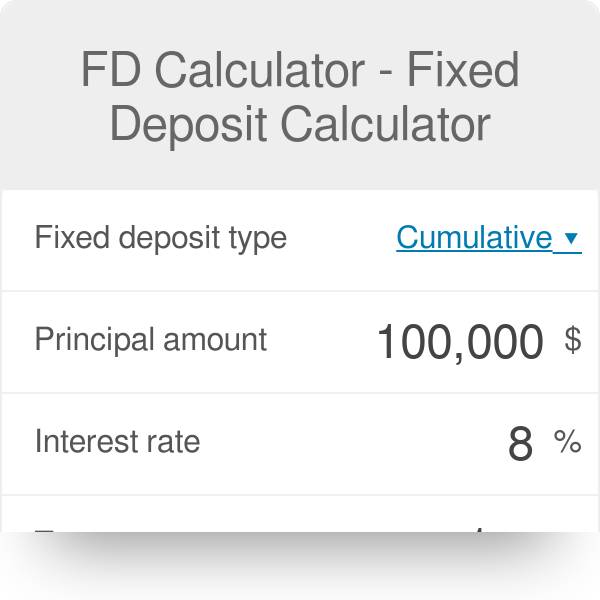

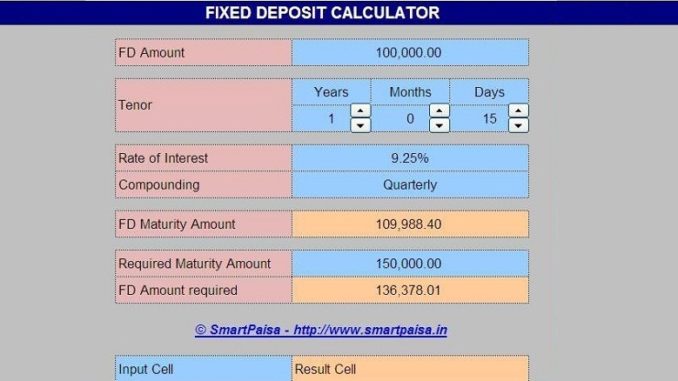

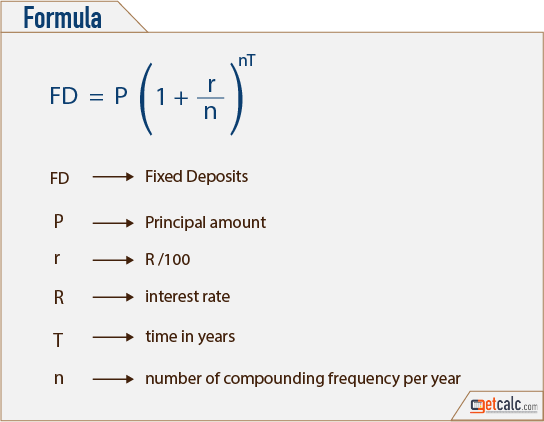

T is the number of years. The essential factors of calculating compound interest are principal interest rate and frequency of compounding in a given duration. The FD return calculator uses the following mathematical formula for simple interest FD calculation.

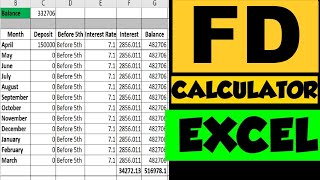

Monthly or quarterly and reinvested into the term deposit the deposit would start to earn compound interest where further interest is earned on interest already paid. Compound Daily Interest Calculator In the world of financial instruments the most. This can vary and might be daily monthly annually.

Term deposit interest is simple interest if you take your interest earned as payments or withdrawals from your term deposit into your savings or transaction banking account. See how much you can save in 5 10 15 25 etc. Term deposit interest rates are fixed but they tend to vary depending on the term you choose thats how long you deposit your money for.

You can invest in two types of FDs simple interest FD and fixed interest FD. Post Office Recurring Deposit Interest Rate. Compound interest P 1rn nt - P.

For example lets say you deposit 2000 into your savings account and your bank gives you 5 percent interest annually. How often you compound determines how quickly your deposit grows with more compounding periods resulting in greater interest accrued. For compound interest.

Year 3 would see a monthly deposit of 10609. The lengthier the term the higher the exposure to interest rate risk. Given Australias record-low cash rate youll struggle to find a term deposit paying over 200 pa.

Compound interest is interest earned on interest already. Well also explore the benefits of a compound interest rate including its long-term effect on your savings account or investment portfolio. This tool will teach you how to calculate and use one to make your money work better.

View the principle and total amount by year in the chart and table. Years at a given interest. Use of a continuous compound interest calculator is among the various benefits of this strategy is the fact that it allows you to visualize investment horizons.

Where P is the principal amount that you deposit and. Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate. Common term lengths range from three months to five years.

Your money earns interest every day if it compounds daily and then the next days interest is calculated based on THAT total instead of on the principal. Plus you can also program a daily compound interest calculator Excel formula for offline use. In fact if you start saving for retirement while youre young by the time you retire your retirement savings could even be made up mostly of market returns.

Compound interest rate CD calculator. You earn interest on top of interest. Free CD calculator online.

Year 2 would see a monthly deposit of 10300. Simple Interest Amortization Calculator is an online personal finance assessment tool which allows loan borrower to find out the best loan in the finance market. Term deposits earn very similar interest rates to savings accounts and are heavily tied to the cash rate.

Particularly when compounding is part of a long-term strategy that includes making frequent contributions to a fund or portfolio. How often you compound determines how quickly your deposit grows with more compounding periods resulting in greater interest accrued. After a year youve earned 100 in interest bringing your balance up to 2100.

The following are the outputs from the calculator. P is principal or the original deposit in bank account. Calculate the CD rate CD interest and capital growth.

Generally the larger the initial deposit or the longer the investment period the higher the interest rate. And also interest is not added to the principal. Years with a savings account at a given interest rate.

You can find many of these calculators online. Factors Affecting Fixed Deposit Interest Rates. The principal amount simple interest rate and maturity period are the key terms to generate the amortization schedule monthly payment and total interest.

The interest rate is defined by r. A compound interest calculator is a simple way to estimate how your money will grow if you continue saving money in savings accounts. But with compound interest after a separately compound term the interest accumulated over that span is added to the principal so that the following estimation of interest incorporates the actual principal plus the previously acquired interest.

The Principle of Compound Interest. Where interest is paid on a term deposit at regular intervals eg. R is the rate of interest per annum and t is the tenor in years.

The calculation formula is. The interest can be compounded annually semiannually quarterly monthly or daily. Suppose you deposited 1000 to a bank for 2 years.

This is how often interest will be calculated on your deposit.

Compound Interest Excel Formula With Regular Deposits Exceldemy

Interest Calculator With Deposits Factory Sale 54 Off Www Ingeniovirtual Com

Fd Calculator Fixed Deposit Calculator

Compound Interest Calculator With Formula

Term Deposit Calculator Investment

Compound Interest Formula And Calculator For Excel

Compound Interest Formula And Calculator For Excel

Difference Between Compound Interest And Simple Interest Explained Shriram City

Deposit Interest Calculator Best Sale 55 Off Www Ingeniovirtual Com

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

How To Calculate Accrued Interest On Fixed Deposit In Excel 3 Methods

Term Deposit Interest Calculator Top Sellers 54 Off Www Ingeniovirtual Com

Time Deposit Calculator Online 55 Off Www Ingeniovirtual Com

Compound Interest Formula And Calculator For Excel

Fixed Deposit Interest Rate Calculator Best Sale 59 Off Www Ingeniovirtual Com

Fd Interest Calculation Fixed Deposit Calculator For Compounding Maturity Withdrawal Youtube

Cd Calculator